Following Tesla’s $1.5 billion buy of bitcoin, Bitcoiners are patiently ready for the subsequent big-name establishment to allocate their treasury to BTC.

One of the seemingly candidates is the pc software program firm, Oracle (Ticker: ORCL). In keeping with its newest 10-Q report, Oracle at present sits on an enormous $43.06 billion in money and short-term investments, with $37.24 billion in money solely. It faces the identical situation that each different company sitting on a big pile of money does: As Michael Saylor would say, Oracle’s treasury is a melting ice dice, eroding away from the unimaginable price of financial provide growth that has occurred during the last 12 months.

M2 cash inventory, there was roughly $4 trillion added to provide since early 2020:

Nevertheless, each firm faces this situation, so why have many been speculating that Oracle would be the subsequent to take an allocation?

Larry Elison, the chief chairman and CTO of Oracle, is thought to be extraordinarily aggressive. As well as, he’s a member of Tesla’s board. Which means that he both was in assist of the choice for Tesla to buy $1.5 billion of BTC, or at the very least was within the room to listen to the arguments made to persuade nearly all of the board to undergo with the choice. Provided that Oracle creates pc software program firm merchandise, its board and govt staff are prone to be technologically savvy; due to this fact rising the probability that they might perceive why Bitcoin is so beneficial as an inflation hedge asset.

Oracle reported its earnings lately and it didn’t disclose that it had made a BTC treasury allocation. But when it had been to take action quickly, this might have an immense impact on the value, and resulting from sport concept, the velocity at which firms transfer to take their very own respective positions in bitcoin would even be affected as nicely.

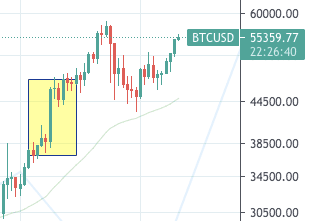

It’s fascinating to notice that the value has been rising steadily during the last 24 hours. This may very well be utterly coincidental, however there’s a risk that market individuals are speculating, or have insider information of, a significant announcement. Within the days previous to Tesla’s announcement of its $1.5 billion buy, there was a gentle improve in value, presumably from insider information of the following announcement.

Regardless, on February 8, when it did make the announcement, biitcoin had a $7,500 day by day candle, a roughly 20 % improve. The same improve in share phrases would push Bitcoin’s value as much as roughly $68,000.

Supply

After all, that is all hypothesis, however one thing to remember. Shifting ahead, it might appear enticing for different Fortune 500 corporations to take a big place, announce it and immediately see value appreciation from the announcement.

This can be a visitor submit by William Clemente III. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin

Be the first to comment