Bitcoin-focused payment firm Strike, has announced its expansion into the European market. According to the company’s announcement, the newly launched offering will enable users across the region to access Strike’s wide range of services, including buying, selling, and withdrawing Bitcoin (BTC).

The move is part of Strike’s expansion strategy targeting 65 nations worldwide.

The latest expansion is also aimed at providing users with unmatched simplicity and convenience when it comes to digital asset accessibility. Customers can easily engage in Bitcoin transactions using euro deposits through SEPA, the payments processor for the region.

More Options for the EU

European users can expect to use Strike to buy Bitcoin directly using free, unlimited SEPA euro deposits from their bank account. They can also sell their Bitcoin and withdraw funds directly to their SEPA bank account, withdraw their Bitcoin to self-custody or send it instantly and without limits to any Bitcoin or Lightning wallet.

Strike’s global peer-to-peer transfers with Lightning are set to enable instant transfers from Euro balance to a friend’s Strike account anywhere the app is available.

In addition, users can also receive funds in various currencies depending on their location: Bitcoin (BTC) globally, Euros (EUR) in Europe, US Dollars (USD) in the US, and Tether (USDT) in supported regions. They can also utilize Strike’s “Send Globally” feature to send money across borders to supported regions conveniently.

As noted, Strike has actively broadened its service footprint over the past few year. As of April, 2024, the firm’s services are accessible to customers in over 100 countries, from Latin America to Africa.

A Big Market

With its European debut, Strike aims to tap into the region’s sizable market for Bitcoin adoption. Explaining the driving force behind this expansion, Strike said Europe, as the world’s third-largest economy, holds big potential for Bitcoin’s integration and adoption.

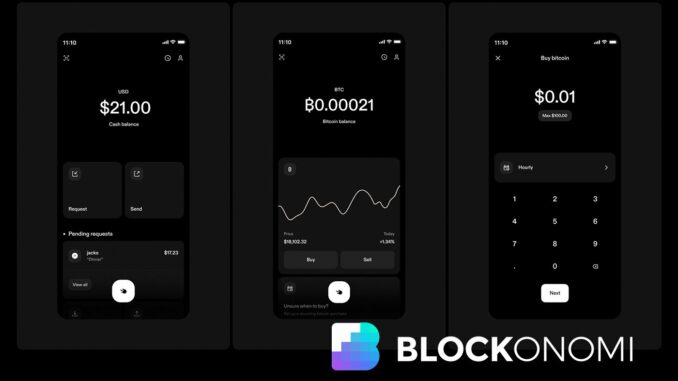

Originally introduced to the US market in 2020 by Jack Mallers, the mind behind Chicago-based Zap Solutions, Strike has garnered attention for its ability to facilitate global money transfers, which can be comparable to popular online payment services like PayPal or Cash App.

The firm differentiates itself from those payment giants with the adoption of the Bitcoin network. Compared to traditional methods, Strike believes this approach is faster and more cost-effective.

In May last year, Strike revealed plans to bring its services to customers across 69 countries following its initial focuses on the U.S. and El Salvador.

In the following month, the company announced it started to offer its cross-border payment service in Mexico. According to the company, Mexico represents the largest remittance market from the U.S., accounting for 95% of the total remittances received from abroad.

Regulatory Roadblock

The demand for cross-border payment services has definitely increased in recent years. Global central banks are reportedly exploring the use of blockchain technology for international transactions.

Bitcoin’s technological innovation, worldwide interoperability, resilience, and immutable monetary policies are fundamentally seen as a viable option. Apart from Bitcoin, banks also eye on stablecoins and central bank digital currencies (CBDCs) to facilitate cross-border transactions.

However, despite increased interest in adopting Bitcoin and other digital assets among financial institutions, regulatory challenges remain. In Europe, for example, embracing digital assets has been hampered by concerns over their legal status and the enforceability of security measures.

The European Central Bank (ECB), the central banking authority for Eurozone countries, has expressed contradictory views on Bitcoin’s value.

Ulrich Bindseil and Jürgen Schaaf, Director General and Advisor of Market Infrastructure & Payments at the ECB, stated in a blog that despite the recent approval of a Bitcoin ETF, Bitcoin remains unsuitable as a means of payment or investment.

According to the ECB executives, Bitcoin’s lack of cash flows, dividends, productive commercial applications, or perceived social value renders it unsuitable as an investment. They suggest that interest in the asset is primarily a fear of missing out (FOMO) and likely influenced by the Bitcoin advocacy group.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether

Be the first to comment