In brief:

The first $1,200 stimulus check has appreciated to $10,278 if the recipient invested in BitcoinThe second $600 stimulus check has appreciated to $1,227 if it also bought BitcoinThe third round of stimmy checks is on its way with details of the rollout expected soonChances are, recipients will buy Bitcoin and/or other digital assetsBitcoin could thus find the fuel to hit $60k

President Biden has signed into law the third stimulus bill worth $1.9 Trillion that will see eligible Americans receive at least $1,400 from the government. As was the case with the first and second ‘stimmy checks’ from last year, chances are that some or all of the amount will end up purchasing Bitcoin and/or other digital assets.

First $1,200 Stimulus Check is Now Worth $10,278 if it Bought Bitcoin

According to BitcoinStimulus.net, the first stimulus check worth $1,200 that was issued on April 15th, 2020, is now worth $10,278 if the recipient bought Bitcoin. Furthermore, such an investment would now be up 757% in gains as seen in the following screenshot courtesy of the stimulus check tracking website.

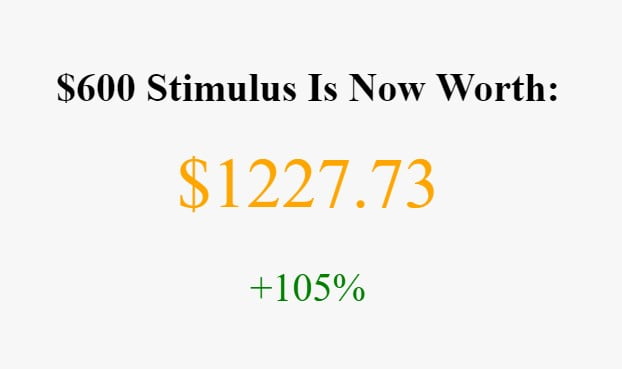

Second $600 Stimulus Check is Now Worth $1,227

The US government went on to issue a second round of $600 stimulus checks on the 29th of December last year. According to BitcoinStimulus.net, that $600 is now worth $1,227 if the recipient invested in Bitcoin. The screenshot below courtesy of the tracking website further demonstrates this fact.

Bitcoin Could Test $60k Once the Third Stimulus Checks Get Disbursed

At the time of writing, Bitcoin has more or less recovered from yesterday’s dip to $55k due to news of Binance being investigated by the CFTC. Bitcoin is currently trading at $57,500 and looks set to conquer the elusive $58k price area as support in the days to follow.

Additionally, between now and next week is when details of the disbursement of the $1,400 will start emerging. This means that Bitcoin could keep pushing higher towards $60k based on the hype and excitement surrounding the stimulus checks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc

Be the first to comment