Michael Saylor confirmed today that Microstrategy purchased an additional 301 Bitcoins at an average price of $19,851 per Bitcoin. According to Saylor, Microstrategy now holds $130,000 Bitcoins acquired at an average of $30,639 per Bitcoin.

MicroStrategy’s former CEO Micheal Saylor revealed today via his official Twitter account that MicroStrategy purchased another $6 Million Bitcoin taking the entire company’s BTC holdings to $3.98 billion at an average price of $30,639 per Bitcoin. Saylor recently stepped down as MicroStrategy CEO, taking the role of executive chairman. His reasoning behind his decision is that he will be able to provide oversight of the company’s bitcoin acquisition strategy.

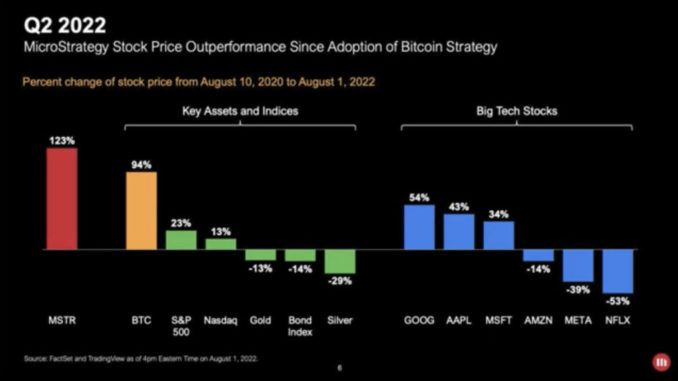

Michael Saylor previously stated that since MicroStrategy adopted the Bitcoin Standard, the company heavily outperformed the S&P 500, Nasdaq, Gold, Bond Index, and any Big Tech Stocks.

Could This Finally Be The Bitcoin Bottom?

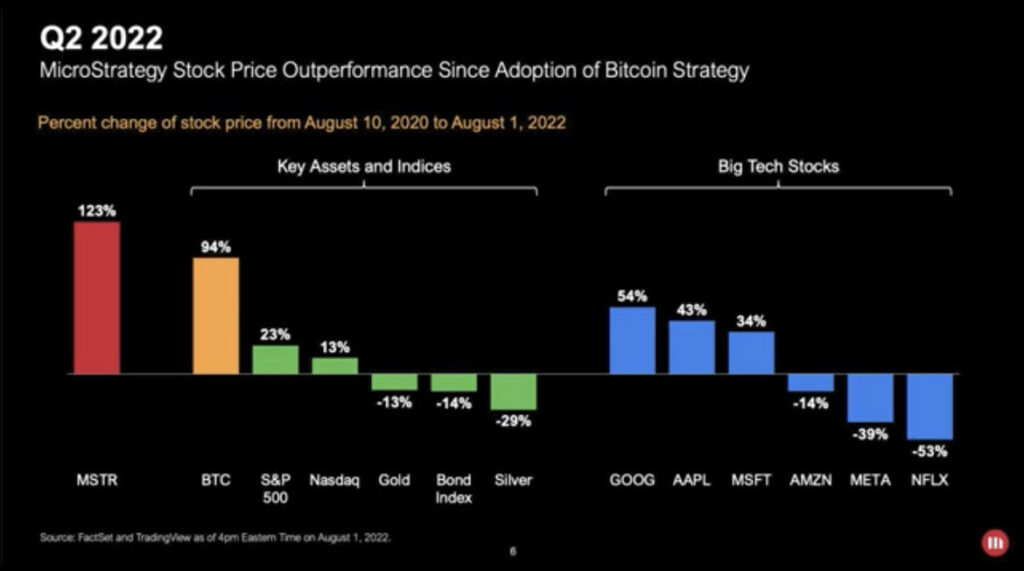

As previously stated, many long-term holder charts are instigating the Bitcoin bottom might be in such as the Bitcoin Investor Tool: 2-Year MA Multiplier.

The chart shows periods when buying and selling Bitcoin would have produced outsized returns.

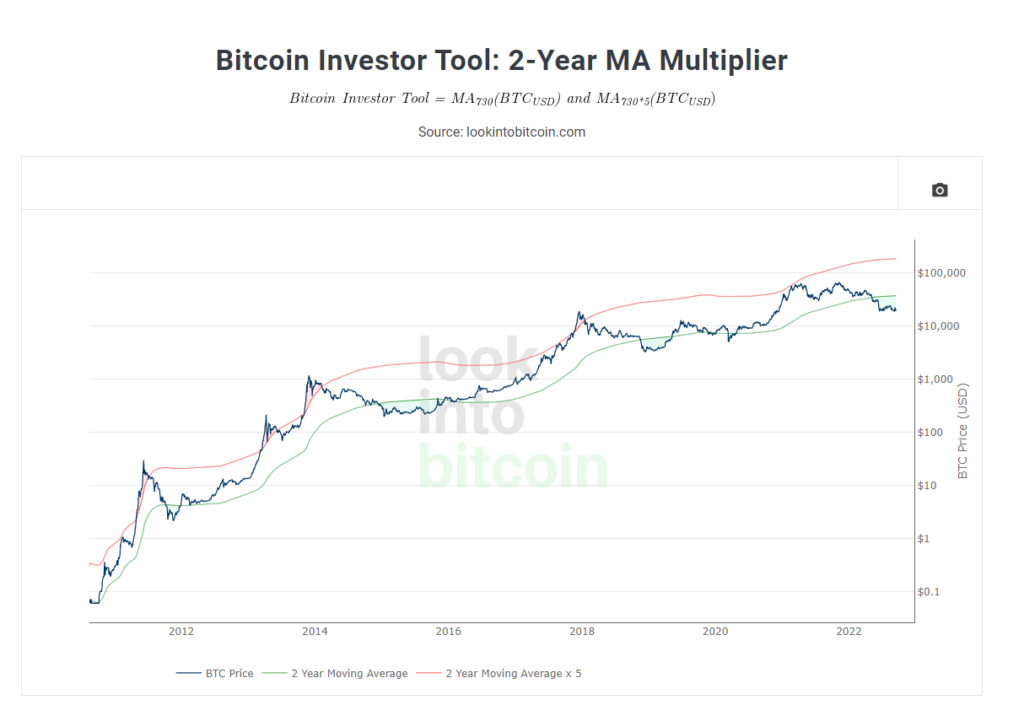

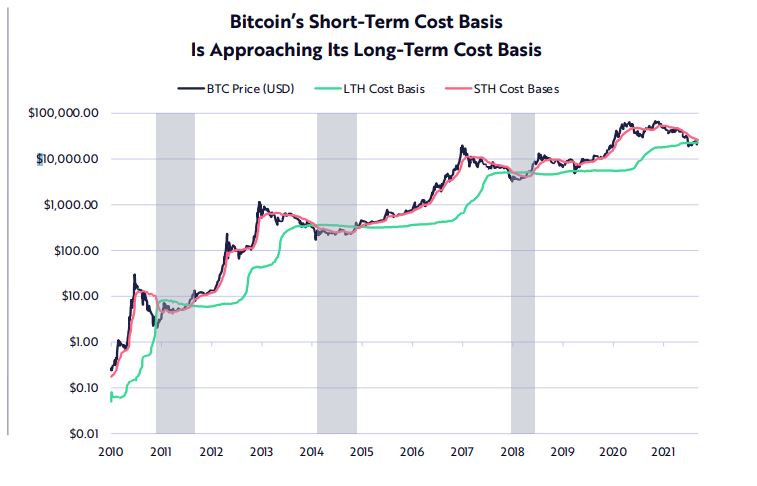

Ark Invest’s Bitcoin Monthly Report also shows that long and short-term cost bases appear to cross, which would historically suggest a cyclical bottom.

According to the report, the supply held by long-term holders is on pace to reach all-time highs, suggesting that the probability of selling and spending in the future diminishes dramatically.

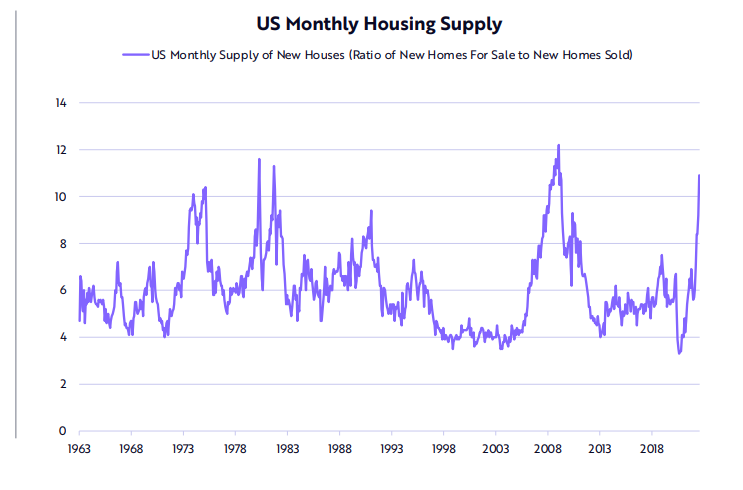

However, on a macroeconomic scale, signs of recession are surfacing as the FED tries to curb inflation. The CPI index has reached highs not seen since the 1980s, and home inventories have spiked dramatically relative to Home Sales, indicating we could be in a recession.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin

Be the first to comment