While a correlation between equities and crypto has become more apparent during the last year, Singapore’s QCP wrote that there is a limit to this correlation because of the increasing importance of the crypto options market.

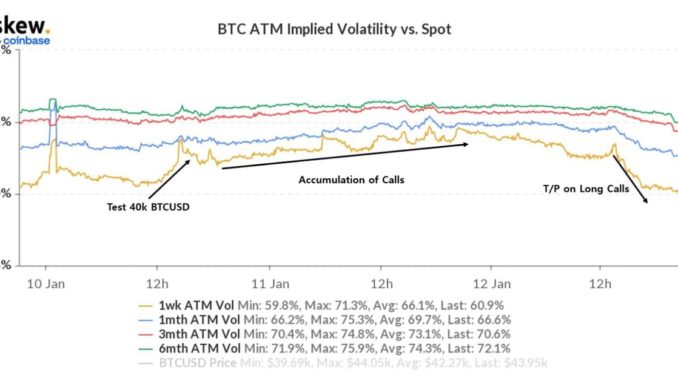

As the bitcoin and ether markets followed the bearish sentiment of the equities market as the week began, bitcoin and ether tumbled below $40,000 and $3,000 respectively.QCP wrote that they believe there was a bounce-back because of the number of strikes at the $40,000 mark for bitcoin, and the $3,000 mark for ether, held by whales.The fund noted that there was a counterparty that was buying a large amount of downside risk reversals (where a trader buys the put and sells the call) who suddenly switched positions to take profit (where they sell the put and buy the call).With the volume of delta trading (simultaneously buying and selling options) on the strikes at $40,000 and $3,000, there was a creation of spot support at those levels, QCP wrote.QCP said that one reason why bitcoin is facing some resistance at the $44,000 market is that a whale began taking profit on his $42,000 January calls as bitcoin drifted towards $44,000.“We think option activity will increasingly dictate spot movements as the option market continues to grow,” the firm wrote.

Read more: Bitcoin’s Near 40% Slide Weighs on Crypto Stocks While Coinbase Outperforms

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc

Be the first to comment