(Bloomberg) —

Cathie Wooden’s Ark Funding Administration is permitting one in all its funds to spend money on Canadian Bitcoin ETFs as the cash supervisor seeks recent methods to wager on digital property.

In a late-Friday submitting for the $5.7 billion ARK Subsequent Technology Web ETF (ticker ARKW), the agency tweaked the fund’s prospectus to incorporate reference to holding publicity to cryptocurrencies by way of “exchange-traded funds domiciled in Canada.”

The transfer comes after the $1.3 billion Amplify Transformational Information Sharing ETF (BLOK), a blockchain-focused product, was final week proven to have a tiny stake in three Canadian Bitcoin ETFs.

Traders and issuers within the $6.8 trillion U.S. ETF market are nonetheless ready for regulators to approve exchange-traded merchandise investing in cryptocurrency. Whereas Canada and Europe have raced forward, an enormous backlog of purposes has constructed up with the Securities and Alternate Fee. Ark is amongst these in line, having teamed up with Switzerland-based 21Shares AG to file plans for a fund within the U.S.

ARKW already boasts some Bitcoin publicity — about 5.5% of the fund is invested within the Grayscale Bitcoin Belief (GBTC), based on knowledge compiled by Bloomberg.

The $30 billion automobile is arguably one of many best methods for buyers to entry cryptocurrencies within the U.S. by way of a fund, however its construction makes it inefficient and its worth continuously detaches from that of the Bitcoin it holds.

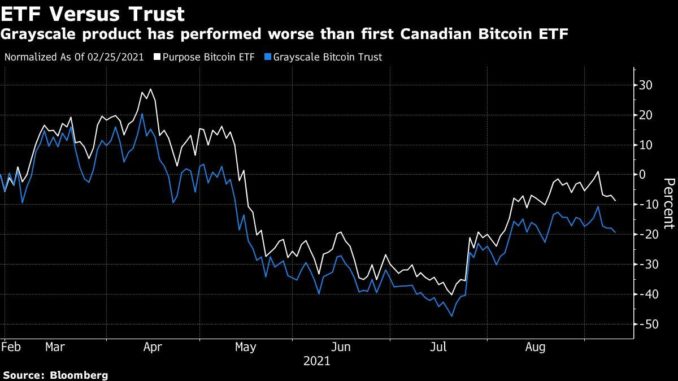

As of Friday, GBTC was down about 20% because the first Canadian Bitcoin ETF launched in February. That fund, the Goal Bitcoin ETF (BTCC) has dropped 9%. ARKW has misplaced about 6.5% since then, however remains to be up 2.3% year-to-date. It has lured about $691 million in new money in 2021.

A spokesperson for Ark didn’t instantly reply to a request for touch upon the documentation adjustments.

Extra tales like this can be found on bloomberg.com

Subscribe now to remain forward with essentially the most trusted enterprise information supply.

©2021 Bloomberg L.P.

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment