As Bitcoin (BTC) continues hovering around the $19K zone, small to mid-sized addresses are scaling the heights, according to Santiment.

The market insight provider explained:

“Bitcoin’s small to mid-sized addresses (holding 0.1 to 10 BTC) hold an AllTimeHigh 15.9% of the coin’s available supply.”

Source:Santiment

Therefore, Bitcoin addresses have been witnessing heightened activity. Santiment added:

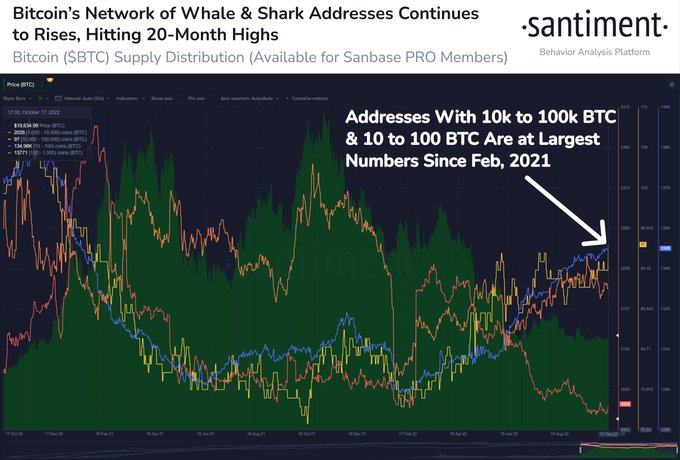

“The number of Bitcoin addresses holding 10,000 to 100,000 $BTC & addresses holding 10 to 100 BTC have reached their highest amount of respective addresses since Feb, 2021. As the number of addresses on a network rises, utility should follow suit.”

Source: Santiment

The market insight provider expects Bitcoin’s use case to surge as the number of addresses increases. This is a bullish sign because demand might rise, pushing prices upwards.

Holding the ground at $19.3K level is crucial

Since Bitcoin has lacked a significant leg up thanks to tightened macroeconomic conditions, Michael van de Poppe believes holding the $19,300 zone is fundamental because this can prompt a push to the $22,000 area. The crypto analyst pointed out:

“The area around $19.3K is key to hold and then we can expand to $22.2K.”

Source:TradingView/MichaelvandePoppe

Similar sentiments were recently shared by analyst Ali Martinez who stipulated that the leading cryptocurrency should stay above $19,200 to reduce selling pressure, Blockchain.News reported.

Bitcoin was hovering around $19,260 during intraday trading, according to CoinMarketCap.

On the other hand, a market analyst under the pseudonym Tajo Crypto believes Bitcoin is not out of the consolidation woods yet based on unfavourable conditions like inflation and interest rate hikes. Tajo Crypto noted:

“Bitcoin has been between $18K and $25K since July and there seems not to be enough catalyst to make it drop to $17K or pump to $26K. The inflation and rate hike will make Bitcoin continue to struggle till prices normalize. Bitcoin consolidation is far from over.”

Therefore, it remains to be seen how the market plays out in the short term because the UNCTAD recently warned that if tightened fiscal and monetary policies continue, a global recession would be inevitable.

Image source: Shutterstock

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin

Be the first to comment