Having traded below $45,000 for seven days now, Bitcoin (BTC) has been in the red based on significant liquidation.

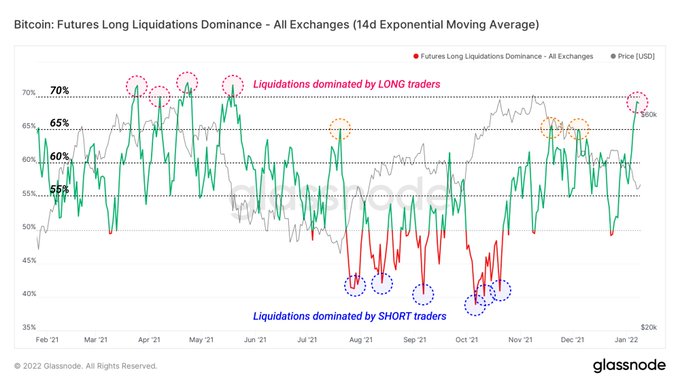

As a result, long liquidation dominance is at levels last seen in May 2021 as traders have been trying to catch the dip. Market insight provider Glassnode confirmed:

“Bitcoin long liquidation dominance has hit 69%, the highest level since the May 2021 deleveraging event. This means that the majority of liquidations in futures markets over recent weeks were long traders attempting to catch the knife.”

Source:Glassnode

On Monday, Bitcoin briefly dipped to a 5-month low of $39,650 as more than 103,839 trades were liquidated. The liquidation was high to the extent that out of $329.63 million, $118.04 million was related to BTC trading positions.

The leading cryptocurrency has gained some momentum to hit $42,133 during intraday trading, according to CoinMarketCap.

Is demand building up at the lower $40K levels?

According to on-chain analyst Will Clemente:

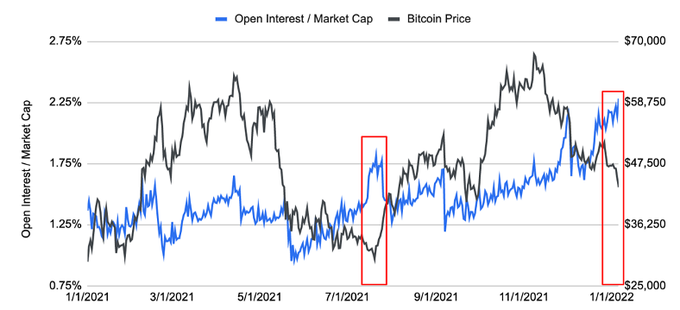

“Bitcoin has now spent 7 days below 45k (prior range low) and still no major open interest wipeout. Either there is sufficient demand down at these levels (low 40s) or this open interest is not aggressive longs.”

Source: Glassnode

On the other hand, crypto analyst Matthew Hyland believes that Bitcoin ought to close above the $42K level on the daily time frame for momentum to build up.

The current downtrend in the Bitcoin market has lasted for 61 days since November 10, when an all-time high (ATH) price of $69,000 was recorded. Whether a potential short squeeze lies ahead remains to be seen.

Source: IntoTheBlock

“The ratio of Bitcoin’s open interest relative to its market cap has reached the highest level in over a year. The last time the OI/MC ratio increased while Bitcoin’s price decreased was in July 2021, which marked the bottom,” according to data analytic firm IntoTheBlock.

Image source: Shutterstock

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether

Be the first to comment