Majority of the cryptocurrency market is currently in a downward spiral as the worlds leading token Bitcoin fell below $33,000. As of press time, BTC is trading at $32,964 and has dipped more than 13% over the past 7 days, per data from CoinMarketCap.

Data from TradingView shows that BTC has not seen these levels since January 2022. Notably, Bitcoin is now trading more than 50% below its $68,000 all-time high from November 2021.

Similar to Bitcoin’s recent price movements, other crypto’s like Ethereum’s ETH and Terra’s LUNA have also recorded massive declines from previous highs. Ethereum is 7% down in the last 24 hours and trades around $2,378 while LUNA prices dipped to $60.34, a 27% crash in the past week alone.

In addition, the global crypto market cap fall fallen to around $1.58 trillion as of the time of writing this report.

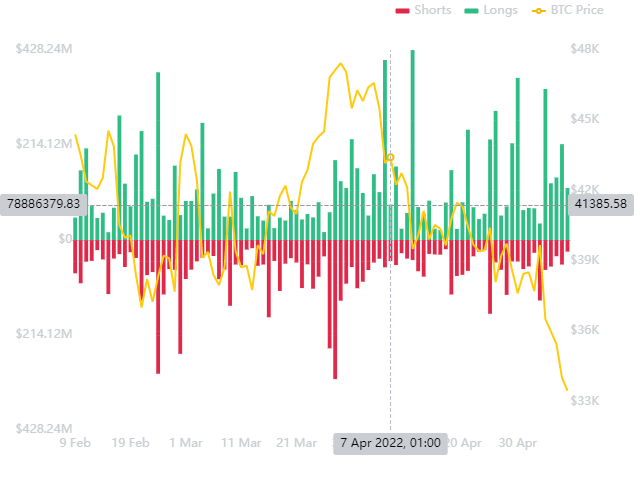

Bitcoin’s Retrace Triggers $280 Million in Long Liquidations

BTC’s most recent crash below the $33,000 region supposedly served as the catalyst for massive losses across the market.

According to data from CoinGlass, traders have suffered over $400 million in liquidations in the past day alone. Furthermore, Bitcoin traders bared the brunt of the losses with more than $139 million in liquidations. Ethereum trades accounted for the second-highest losses with an estimated $120 million in liquidations.

Other tokens with significant losses included LUNA, SOL, DOGE, TRX, GMT, and APE to name a few.

Bitcoin Analyst Says Dip To $24K Might Happen

As the markets continue to take a tumble, a prominent crypto proponent and analyst has predicted a possible slump to lower levels.

According to the Head of Market Research at Bitcoin Magazine, Dylan LeClair, BTC could hit a bottom price of $24,300 in line with historical price patterns during bear markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin

Be the first to comment