Bitcoin (BTC) was up by 2.05% in the last 24 hours to hit $44,907 during intraday trading after briefly nosediving below $40K on September 22, a fate not seen since August 5.

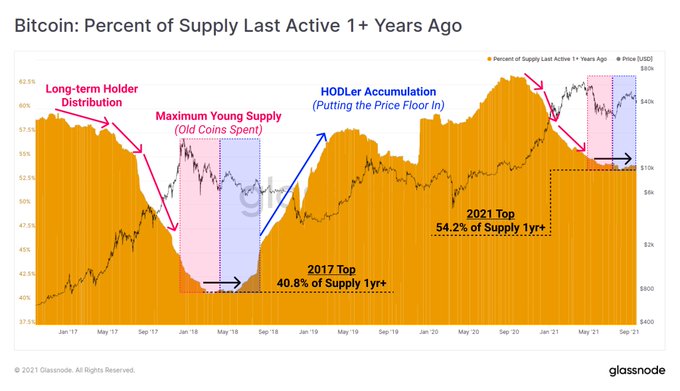

Glassnode acknowledged that a large portion of Bitcoin supply was stored in cold storage. The on-chain metrics provider explained:

“The Bitcoin supply that has been dormant for at least 1yr is starting to bottom out at 54.2%. Compared to the 2017 top, this indicates that a larger relative proportion of BTC remains in cold storage.”

Therefore, more Bitcoin supply being kept in cold storage signifies a holding culture. This is bullish because investments are held for future purposes other than speculation.

Holding is a favoured strategy in the Bitcoin market, with long-term holders and crypto whales leading the race.

For instance, Bitcoin supply has been steadily maturing to old hands, given that nearly 2 million BTC have transitioned from short-term to long-term holders from the time an ATH price of $64.8K was attained in mid-April.

Meanwhile, the Bitcoin Lightning Network has been gaining steam because it recently hit an all-time high (ATH) capacity of 2,738 BTC. This is a second layer incorporated into the Bitcoin blockchain to undertake off-chain transactions. As a result, micropayment channels are utilized to scale the blockchain’s capacity to carry out transactions more efficiently.

On-chain analyst Will Clemente acknowledged the Lightning Network growth was crucial for Bitcoin to eventually transit from primarily being used as a store of value to a medium of exchange.

Is the journey towards $50K still open?

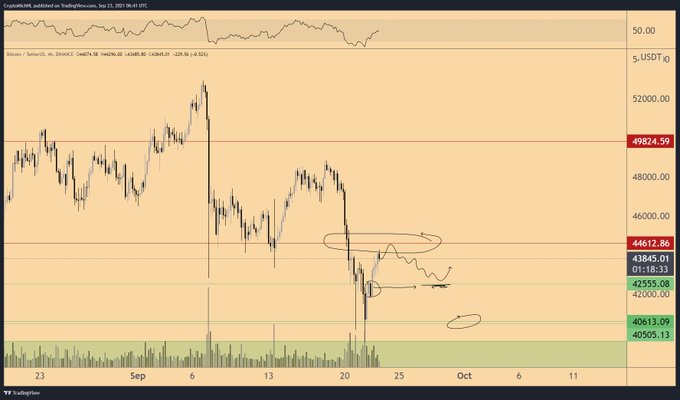

According to market analyst Michael van de Poppe:

“Bitcoin is looking at resistance, but showing a great daily candle. A breakout above $44.6K and a path to $50K is open. If we correct, then I’m looking around the $42K region for support.”

Earlier this month, BTC breached the psychological price of $50K and scaled to the $52,000 level. Nevertheless, the leading cryptocurrency experienced a significant pullback that prompted a $10K loss as over-leverage factors dominated.

Furthermore, Bitcoin’s quest to retest the $50K zone was recently dented by a significant liquidity challenge experienced by China Evergrande, a leading Asian property developer. This development is one of the factors that made Bitcoin briefly drop below the psychological price of $40K.

Image source: Shutterstock

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment