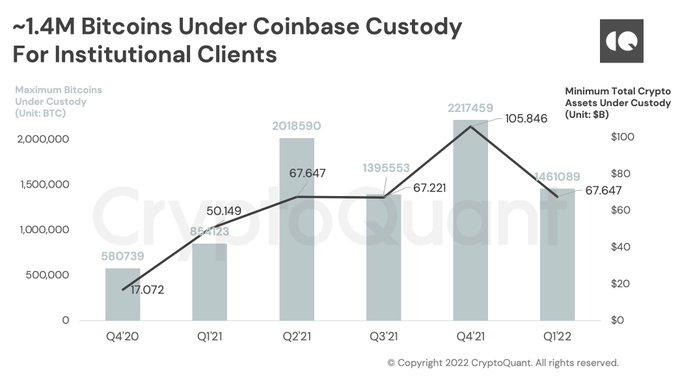

Despite the ups and downs experienced in the Bitcoin market since the fourth quarter of 2020, crypto exchange Coinbase continues to hold 1.4M BTC for institutional customers.

Market insight provider CryptoQuant stated:

“Bitcoin under Coinbase custody for institutional clients increased by 296% since Q4 ’20.”

Source: CryptoQuant

Bitcoin under Coinbase custody for institutional investors has increased from 560,739 BTC recorded in the fourth quarter of 2020 to hit 1,461,089 BTC in the first quarter of this year.

The journey since then has not been smooth sailing based on the hiccups experienced in the Bitcoin market.

For instance, BTC breached the then all-time high (ATH) of $20,000 in December 2020 after trying to do so in vain for nearly three years. Afterwards, the leading cryptocurrency set a relatively high of $64.8K in April 2021, but a month later, things went haywire after shedding more than 50% of its value to hit lows of $30,000.

This downward trend was triggered by China’s intensified crackdown on crypto mining.

However, Bitcoin was able to dust itself off by setting a new ATH of $69,000 in November 2021.

Based on BTC’s current price of $31,500, the maiden cryptocurrency has lost more than 50% of its value since the record high of $69K, but institutional investors are still holding strong.

Market analyst Ali Martinez recently acknowledged that BTC has been leaving crypto exchanges, signalling a holding culture.

He pointed out:

“Roughly 40,000 BTC have been withdrawn from known cryptocurrency exchange wallets while whales had added over 30,000 BTC to their holdings over the past week.”

Source: Santiment

Therefore, holding is a favoured strategy in the Bitcoin market because coins are kept for future purposes other than speculation.

Image source: Shutterstock

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether

Be the first to comment