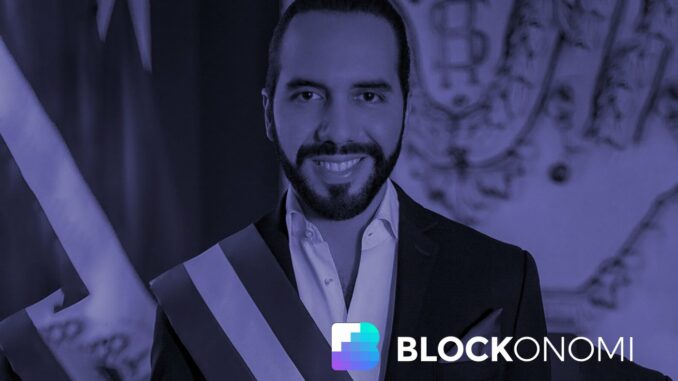

The small Central American nation of El Salvador and its controversial president Nayib Bukele have reaped sizable rewards from an unorthodox economic gambit – adopting bitcoin as legal tender in 2021.

TLDR

El Salvador’s bitcoin holdings have gone up over 40% in value and would net a $41.6 million profit if liquidated

The country’s bitcoin stash was acquired at an average price of $44,292 and now totals 2,381 BTC

El Salvador’s president Bukele asserts they have no plans to sell their bitcoin, citing the HODLer’s mantra that “1 BTC = 1 BTC”

Additional bitcoin has come via a citizenship program where donations earn fast-tracked citizenship

The country’s bonds have also rallied over the past year, trading above 80 cents on the dollar

As the world’s first country to officially endorse bitcoin for payments and proactively accumulate it as part of national reserves, El Salvador initially faced skepticism from mainstream economists and press. But bitcoin’s stellar rebound from 2022 lows has silenced many critics.

President Bukele took to social media this week to trumpet the nation’s bitcoin winnings, claiming “if we were to sell, we would make a profit of over 40%.” Based on purchase figures shared periodically by Bukele himself, El Salvador holds 2,381 BTC acquired at an average cost of $44,292.

When #Bitcoin’s market price was low, they wrote literally thousands of articles about our supposed losses.

Now that #Bitcoin’s market price is way up, if we were to sell, we would make a profit of over 40% (just from the market purchases), and our main source of BTC is now our…

— Nayib Bukele (@nayibbukele) February 28, 2024

With bitcoin changing hands near $63,000 this week before pulling back slightly, El Salvador’s bitcoin stash now carries a healthy positive return of $147 million in cold hard value. That even factors in transaction fees from the country’s much maligned “Bitcoin Beach” wallet called Chivo.

Assuming a first-in-first-out cost basis model, if the government liquidated its entire stack at present values, it would net $41.6 million in profit – a 40%+ gain as Bukele notes proudly.

Despite the temptation to crystallize gains, Bukele insists “we won’t sell, of course.” Channeling Bitcoin OG HODLers, he tweeted philosophically that “1 BTC = 1 BTC” no matter the USD conversion rate. This echoes MicroStrategy CEO Michael Saylor, another controversial bitcoin bull, who faces similar chances to cash out his corporate treasury’s gargantuan $6 billion bitcoin position but remains committed to simply holding through volatility.

Beyond righteous vindication for his crypto vision, Bukele also pointed to the marked recovery in his country’s bonds over the past year. After hitting distressed lows of 50 cents on the dollar last summer, El Salvador’s debt due in 2052 has bounced back to trade above 80 – signalling a tentative thumbs up from finicky fixed income traders.

Buoying Bukele’s standing, bitcoin isn’t the only ball he’s knocked out of the park lately either. The young populist secured a landslide re-election earlier in February, winning over 85% of votes on the back of another pet policy – getting ultra-tough on notorious street gangs. Through aggressive law enforcement initiatives condoned by a fearful public, Bukele has helped slash El Salvador’s high murder rate by as much as 90% while jailing some 50,000 suspected gangsters.

Combining high octane social policies with an absolutist embrace of bitcoin’s disruptive potential, the non-conformist Bukele definitively XX. His big bitcoin bet graphs much like his fledgling political career – marking him as one to watch on the global stage.

Yet risks remain ever present with such experimental economics. The IMF still warns bitcoin’s adoption risks financial stability in a largely dollarized country already struggling with poverty, inequality and inflation.

If crypto markets turn south again for an extended bear season, Bukele’s bitcoin bravado could haunt him, but for now at least, he’s earned the right to gloat while El Salvador’s bold bitcoin experiment stays in the black.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano

Be the first to comment